texas property tax lien loans

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Welcome to the Official TEXAS PROPERTY TAX LOANS website.

Pin By Gvanwage On Lawyers Title Frisco Tx 75034 Title Insurance Dfw Real Estate Best Titles

Learn the components of liens in Texas the relevance of liens how to enforce a lien and collect a judgment the statute of.

. A property tax loan is a loan where you and the lender negotiate agreed upon terms and the lender pays your tax obligation to the county or applicable tax office. A The contract between a property tax lender and a property owner may require the property owner to pay the following costs after. Check your texas tax.

TAX LIENS AND PERSONAL LIABILITY. History of the Property Tax Loan. The tax office reflects.

If you fall behind on your property taxes the local taxing authority can foreclosure on the property. Property Tax Funding has helped over 10000 residential and commercial property owners in Texas avoid costly interest fees and penalties charged by the tax assessor on past-due. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

We provide easy approval and fast funding in Texas. On 05102022 FYP LLC DBA TEXAS PROPERTY TAX LOANS filed an Other court case against KUNG RICHARD in Harris County District Courts. Register for 1 to See All Listings Online.

Our online application process is simple. With three base locations in Dallas. Ad HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

99 of our applications are approved usually within the same day. Ad Take Advantage Of Historically Low Farm Loan Rates Apply Today. Ad Avoid Up To 47 in First Year Interest and Fees.

We offer flexible terms and attractive. This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders. Texas liens are documents that serve a legal security for a loan.

Call Today For Your Free Quote 800 688-7306. In 1933 Texas state Legislature allowed third parties to settle someone elses property taxescurrent or overduefor the first time. Ad HUD Homes USA Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Contact the OCCC to ask them about the company you are. Once your Texas property taxes are late youll. Property tax lending lets owners avoid this scenario and gives them more payment options and ways to renegotiate payments if they fall behind.

Find out if youre eligible for a property tax loan in Texas. We are Texans Serving Texans. Texas property tax loans by Hunter-Kelsey are available to Texans who may be behind or unable to pay their residential and commercial property taxes.

Our ten member companies are committed to upholding high standards of ethical conduct and. Buy Tax Delinquent Homes and Save Up to 50. A tax lien essentially is an interest in the property that vests the government with certain rights with respect to that property.

Ad Avoid Up To 47 in First Year Interest and Fees. Just remember each state has its own bidding process. Court records for this case are.

An article from legal self-help publisher Nolo on the. A On January 1. Check your Texas tax liens.

A property tax lender makes loans to property owners to pay delinquent or due property taxes. Property tax payment loans can allow Texas residential and commercial property owners to avoid accruing significant county interest taxes fees and penalties on their delinquent property. Calculate Your Loan Savings With Historically Low Rates Save Today.

Since 2007 Propel Tax has made over 600M in property tax loans across Texas. Learn more from Tax Ease. For commercial properties the tax rate is calculated as an amount per 1000 of the propertys assessment.

See why over 50000 Texans have relied on us for help with property taxes. The lender receives a superior tax lien allowing it to foreclose on the. For a median-priced home of 151500 property tax will be around 2775.

Its easy to pay off your property taxes when you call Tax Ease. Find out whats true and whats not in this helpful article about tax lien loan myths and paying back property taxes in Texas. The Texas Property Tax Lienholders Association TPTLA is a statewide alliance of companies.

While a tax lien is not quite an ownership interest in the property. This case was filed in Dallas County District Courts Dallas County. Texas property tax loans are especially beneficial for taxpayers in the state because of the harsh penalties and fines associated with tax liens.

Weve helped thousands of Texans save time and money with Texas property tax loans. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. Tax lien sales may be a good deal for the investor but the property owner should avoid this at all costs.

Tax liens and personal liability chapter 351 texas finance code. We operate in every Texas. We are Texans Serving Texans.

On 06202017 TEXAS PROPERTY TAX LOANS filed a Tax - Other Tax lawsuit against QUINCY COOPER. Lien transfers are a form of tax lending but.

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Unfair And Unpaid A Property Tax Money Machine Crushes Families Wealth Management

/GettyImages-CA21828-a19376e37c97499799e45f8aa4940dd3.jpg)

Tax Lien Certificate Definition

Property Tax How To Calculate Local Considerations

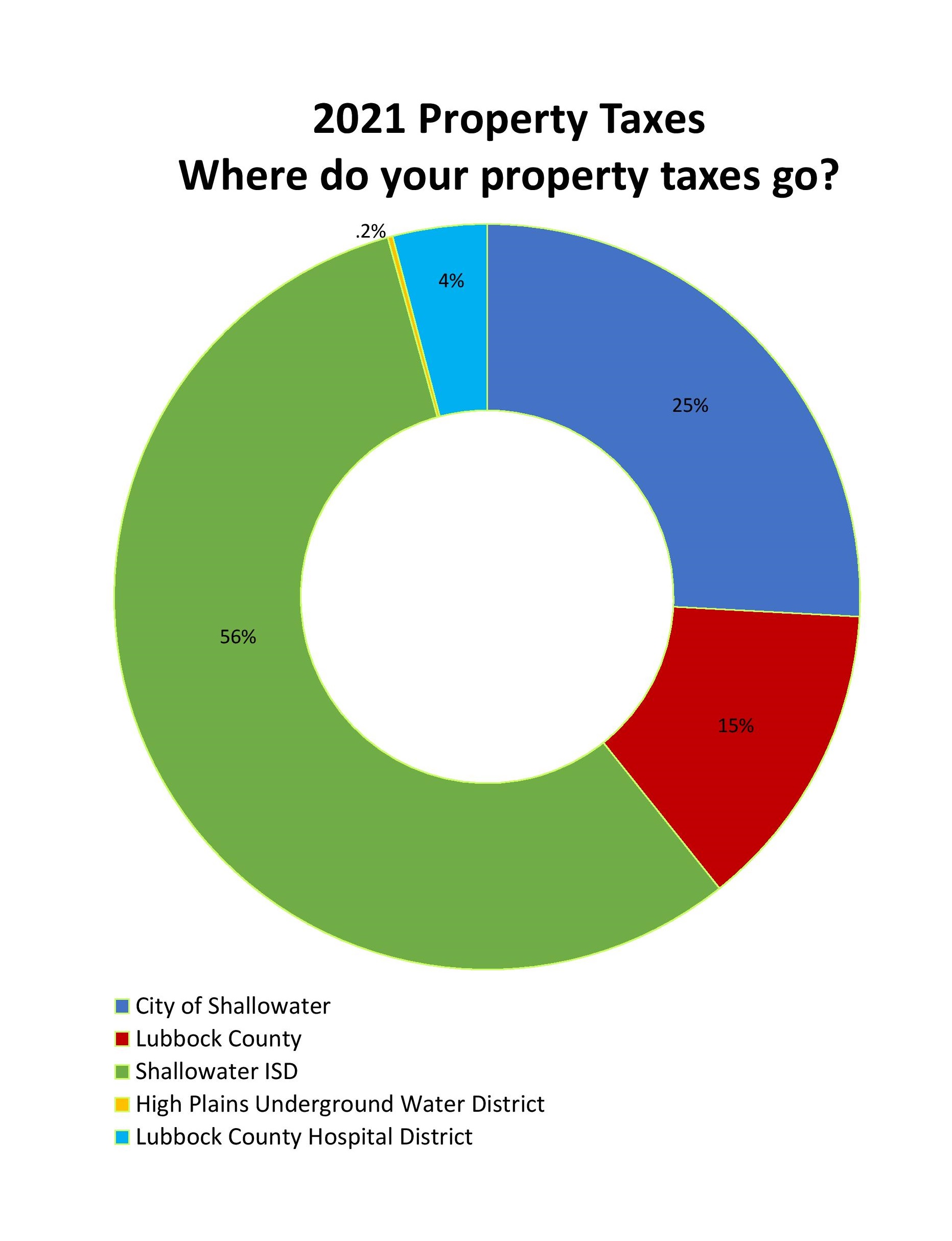

Property Taxes Shallowater Texas

Budget In Excel Simple Budget Template Excel Budget Template Budget Template

Notice Of Forfeiture Of Contract By Seller0001 Real Estate Forms Legal Forms Word Template

Benefits Of Texas Property Tax Loans Texas Property Tax Funding

What Happens When Your House Goes Up For Auction Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

Property Tax Certificates Hoa Certificates When You Want Them Property Tax Certificate Tax

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

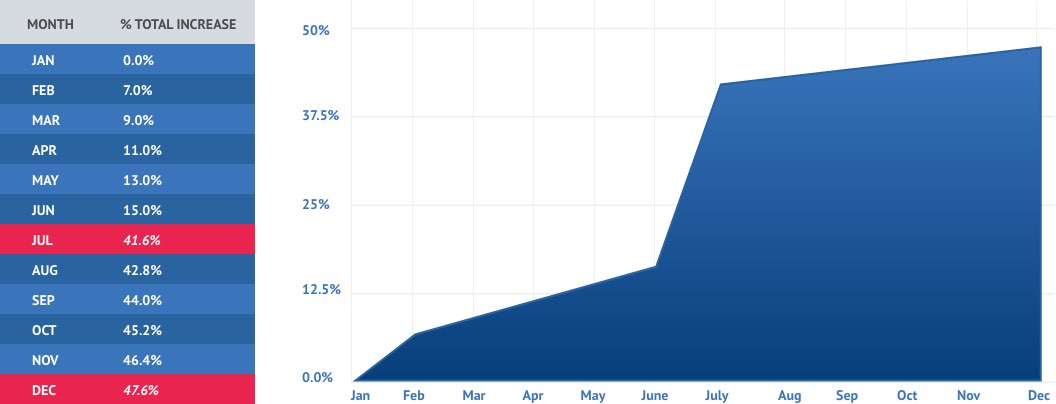

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Free Deedtotrustee 1 Form Printable Real Estate Forms Real Estate Forms Legal Forms Word Template

How To Find Tax Delinquent Properties In Your Area Rethority

Delinquent Property Tax Sale Learn About The 3 Types Of Tax Sales To Earn Amazing Profits Tax Lien Certificates And Tax Deed Authority Ted Thomas

Basics Of Property Taxes Mortgagemark Com

Delinquent Property Tax Sale Learn About The 3 Types Of Tax Sales To Earn Amazing Profits Tax Lien Certificates And Tax Deed Authority Ted Thomas